Integrated Financial Training: Westchester NY |

|

Empowering you to Manage your Money and your Happiness |

|

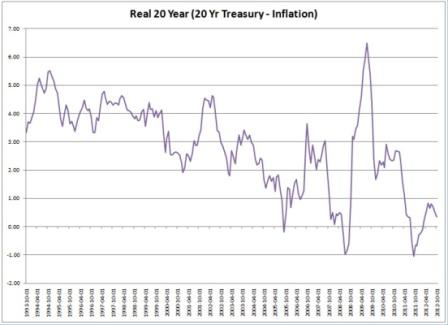

When opportunity knocks, grab it. When there is no opportunity, make one. If neither exist, do nothing... Summary In the article on diversification we pointed out that if you do not know with certainty what will happen in the future, you should not structure your financial life as if you did. Instead, a healthy sense of humility can encourage those who are fearful to take appropriate risks and those who are overconfident to scale back on absurd risks. Here we are not talking about owning two assets moving in opposite ways at the same time, but recognizing reinvestment risk over time. Diversification can be applied to time as well as to assets with the same effect. For those who invest heavily in fixed income portfolios, the techniques of managing reinvestment risk may be important than one suspects. Low interest rate environments have occurred repeatedly throughout history and the impact can be material on one's finances. Here we discuss how one manages a bond portfolio over time. Maintaining a laddered portfolio that matches one's actual expenses is the straight forward strategy. But in periods when interest rates are very low, there may be a large opportunity cost in rolling over long term bonds at low rates. The situation can be managed passively, by just rolling it over, or actively by waiting for better opportunities. Both are discussed. Investing in Bonds When Rates are Low The basic strategy for diversification is to create a laddered portfolio of bonds with an amount similar to your expenses (or some percentage of them) maturing each year. In this way you will only be subject to reinvesting a small percentage of your assets in each year. Also, the portfolio mirrors your expenses, which represents your reason for investing. If the bonds you purchase are inflation protected, your financial situation could largely offset any inflationary increase as well. So goes the theory. But we need to look at the details to understand how all this works in practice. The first question arises when we ask if it makes sense to actively manage this risk rather than automatically roll over the maturities without thought. In the article on investment process, we discussed the benefit of avoiding the really big mistakes, but a willingness to make smaller ones. In this way we can add a small amount to our returns over a long time, producing a significant benefit. To look at that principle here, let's download the interest rate history from the Federal Reserve Bank of St Louis in FRED (their database), looking for say the history of the twenty year note less inflation monthly from 1993 to present. This represents the real rate during a reasonably low inflation period (1-3%). Chart 1 shows the peaks in 20 year real rates roughly 2-3 years apart with one possible period of 6 years. (TIPs historical data for the constant maturity series begins in 2003, so it is too new to be useful) . Note that we are in a new age with rates hovering around 0%, down from a consistent 2+% region.

If for example we invest in 20 Year TIPS in a laddered style with 5% maturing every year, in 6 years time we will only accumulate 30% of the portfolio in cash where it needs to be reinvested. If you invest 3% or so every year with the longest being 30 years, you will accumulate 20% in cash in 6 years. As a cautionary statement, very long term bonds that are not inflation protected can subject you to significant risk in the event of an inflation shock, whereas for inflation protected bonds the risks are far less. This subject is beyond the scope of this article. So when your first position matures and the new rate is 0% for 20 years, what do you do? If you put a real return of say 0% to 2-3% in your financial plan for your bond portfolio, that will give some measure of the maximum amount you can gain from actively managing this risk with the intent of avoiding the really large mistakes. The risk can also be calculated by taking a 20 year TIP and calculating the return after say five years and comparing it to an alternative of say a five year treasury. The net result of these calculations (which can be performed with rudimentary knowledge of finance in seconds) show the TIPs were a worse deal than the 5 year note by 12.4% before tax (TIPs usually have some set backs with taxes, especially when inflation is higher). With a 1 year horizon the TIPs were 28.9% worse, and they broke even to rolling over shorter term treasuries at 7.7 years. The benefit of the TIPs is that with a sudden inflationary increase say to 5%, they break even with the 5 year notes in roughly 5 years, down from 7.7 For instruments that are rated AAA, US government issued, the best hedge against your expenses and supposedly safe, it is very important to recognize the impact of your short term decisions at that first rollover point can be as much as 30% of the value of your assets with a sudden rate shock. But with diversification, other times the ratios may be 30% in your favor. We can also clearly see the value of reducing our exposure to this sort of risk through laddering a portfolio, so our entire portfolio is not subject to such large swings at a single moment. Here we see the importance of doing an analysis to see the most important areas that deserve our attention. However, as explained in the investment process article, we need to eliminate greed as well as fear from the process. If you want to try to avoid the large mistakes, then determining whether you have an advantage in making rate forecasts here would be the first order of business. If you don't, perhaps you can find an advisor or fund that can explain why they have an advantage, but you need to measure the fees to be sure they do not swamp the expected benefit. To pull this off skillfully, you need to know yourself and the other players in the financial arena. Alternatively the naive roll over strategy can be used as well. When opportunity knocks, grab it. When there is no opportunity, make one. If neither exist, do nothing... If you've made it this far, please email us feedback - tell us what you think and if there is any way to be more helpful. Legal - The purpose of this site and all services offered are educational in nature and not to provide any investment advice, planning or recommendations of any securities. The purpose is to educate you to make your own financial decisions, or prepare you to evaluate your financial advisors with confidence so you can gain trust in the services they provide.

|

Integrated Financial Education: Westchester NY - 168 Bell Rd, Scarsdale, NY 19583 914-648-0492